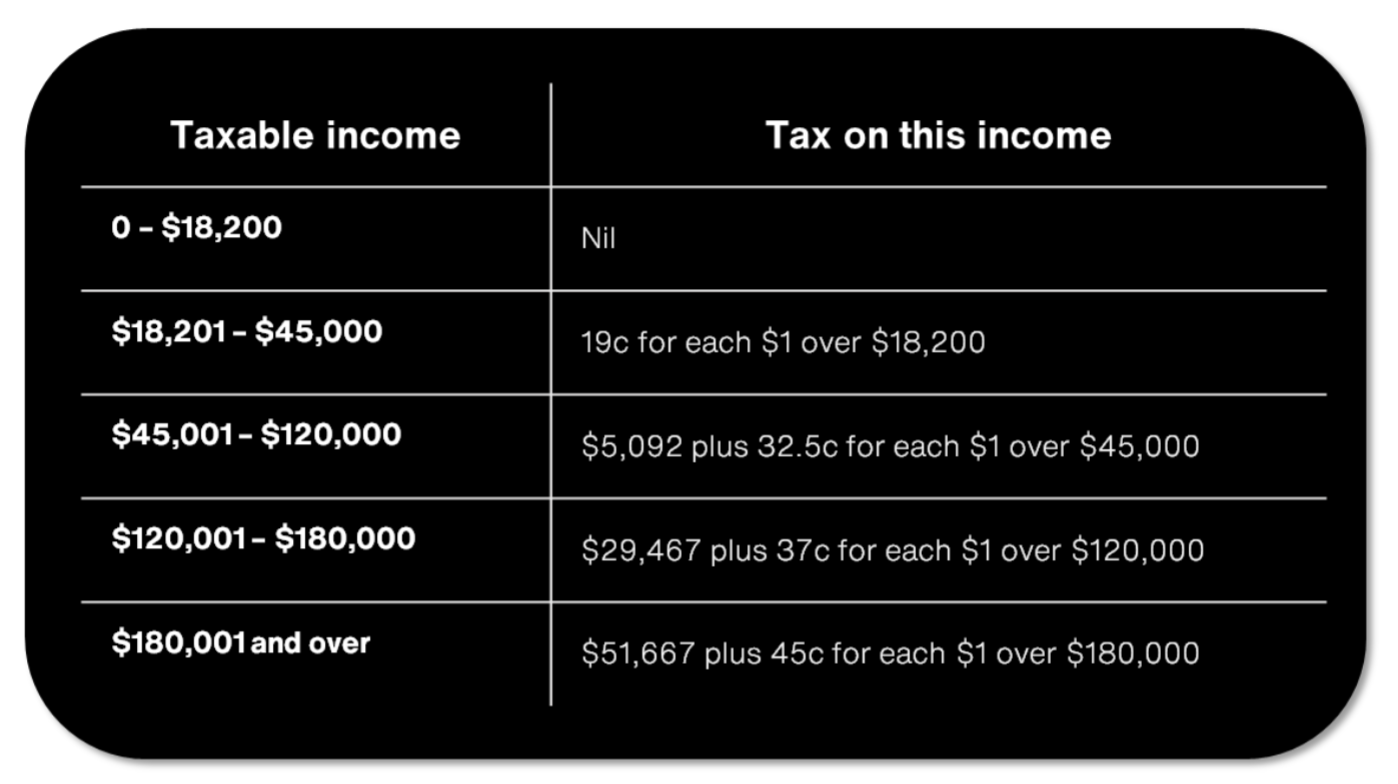

Tax Credits Christmas 2024au. Find out which expenses you can claim as income tax deductions and work out the amount to claim. On 25 january 2025, the government announced changes to individual income tax rates and thresholds from 1 july 2025.

The notice of assessment will either show tax amounts you need to pay or will receive as a refund. No more payments will be made after that.

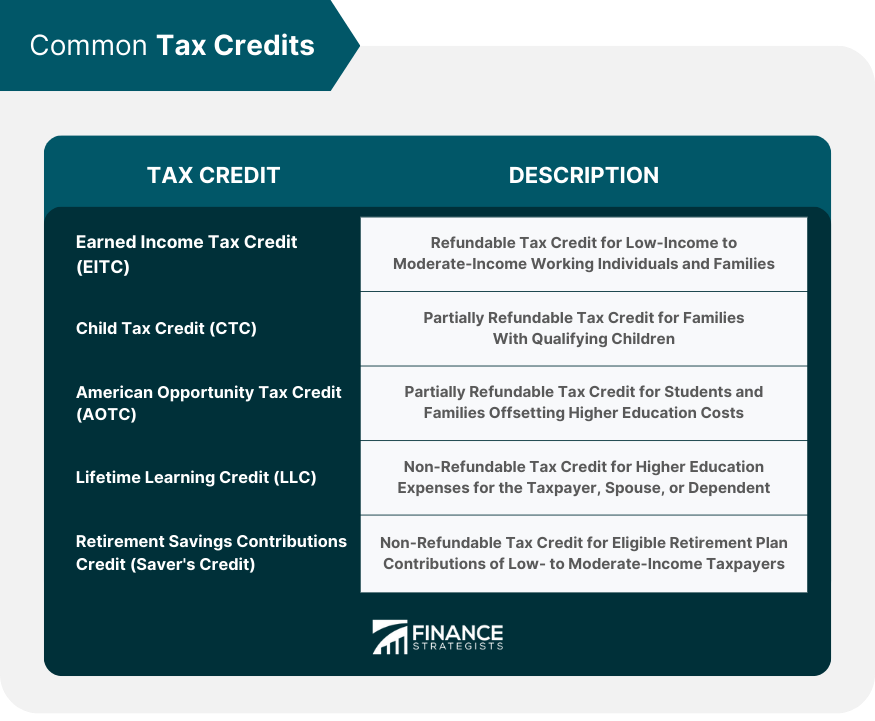

The top 4 Christmas tax questions Walsh Accountants, They reduce the amount of taxes owed by individuals or. Check the fuel tax credit rates from 1 july 2025.

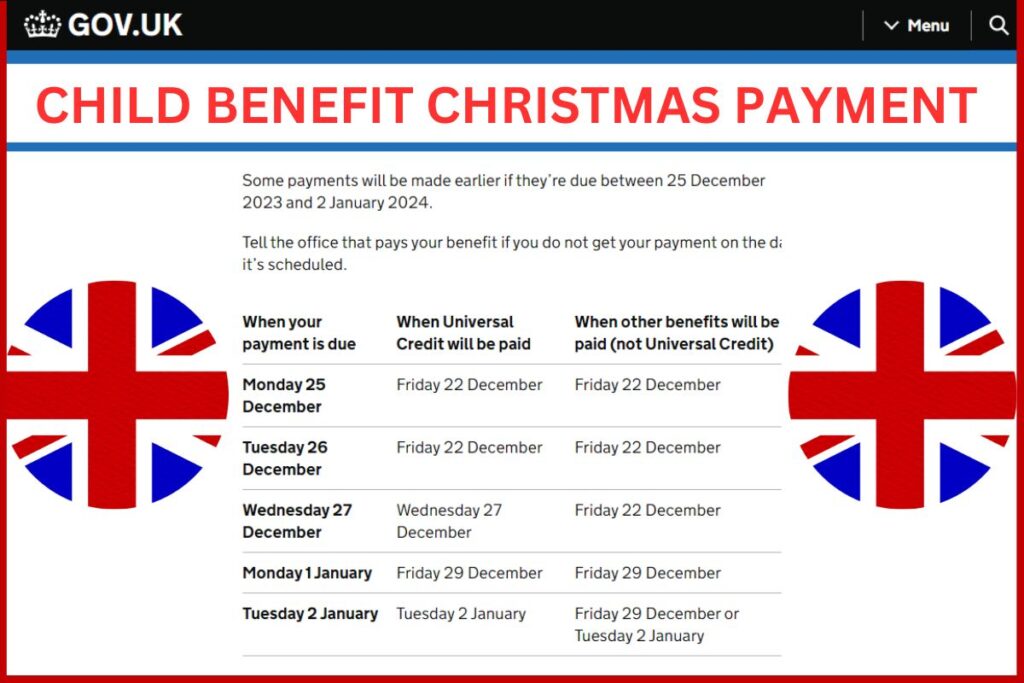

Ginger Baldwin Kabar Child Tax Credit Christmas Payments 2025 When, There are a number of reasons why you may receive a tax bill. Tax credits end on 5 april 2025.

Ginger Baldwin Kabar Child Tax Credit Christmas Payments 2025 When, This article outlines the fbt rules that are relevant at this time of year and the kinds of benefits employers can provide to their employees, their employees’ associates and. You need to use the rate that applies on.

Employer Tax Credits and Tax Holiday Alloy Silverstein, Find out which expenses you can claim as income tax deductions and work out the amount to claim. Tax credits end on 5 april 2025.

What Are Tax Credits? Ramsey, Individuals with a taxable income below $22,575 will not pay income tax, due to the. Last updated 30 january 2025.

Nonrefundable Tax Credits 2025 2025, This is a refund of excess franking credits. If your expense includes an amount of.

2025 Corporate Advantage Group, The ato says you carry forward unused cap amounts from up to five previous financial years, but then they disappear if you don’t pump them into your super. On 25 january 2025, the government announced changes to individual income tax rates and thresholds from 1 july 2025.

Tax Deductions Vs. Credits remastered Etsy UK, Enter your annual taxable income to see your annual tax cut. The ev tax credit was revised and modernized as part of the inflation reduction act, which passed in 2025.

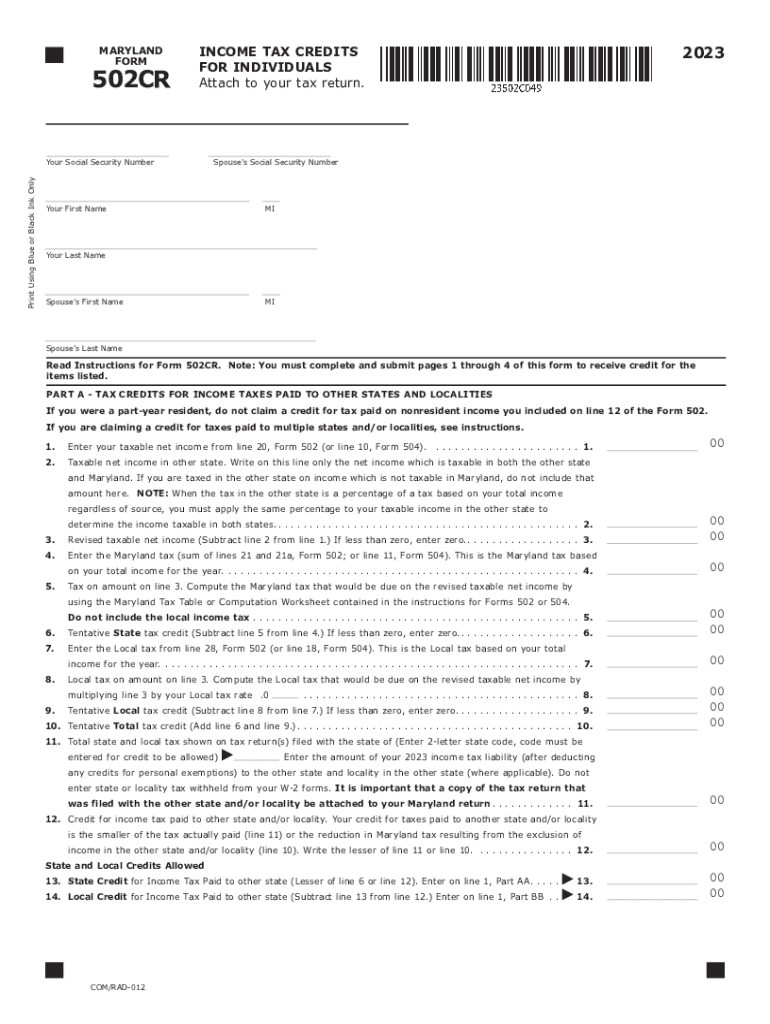

502CR TAX CREDITS for INDIVIDUALS Tax Year 502CR TAX, Individuals with a taxable income below $22,575 will not pay income tax, due to the. Tax credits end on 5 april 2025.

Maximizing Your Tax Return A Guide to Overlooked Deductions and, Irs tax credit schedule 2025: On 25 january 2025, the government announced changes to individual income tax rates and thresholds from 1 july 2025.

The ato says you carry forward unused cap amounts from up to five previous financial years, but then they disappear if you don’t pump them into your super.